Freddie Mac’s recent article entitled “How Planning Your Estate Can Help You Prepare for the Future,” says that estate planning refers to the process of deciding where and how assets are distributed once the original asset holder is incapacitated or has died.

You’ve spent a lifetime building wealth, and estate planning helps you protect it. It can also help you define your legacy by determining when and how to transfer wealth or assets to your beneficiaries and preparing for the unexpected.

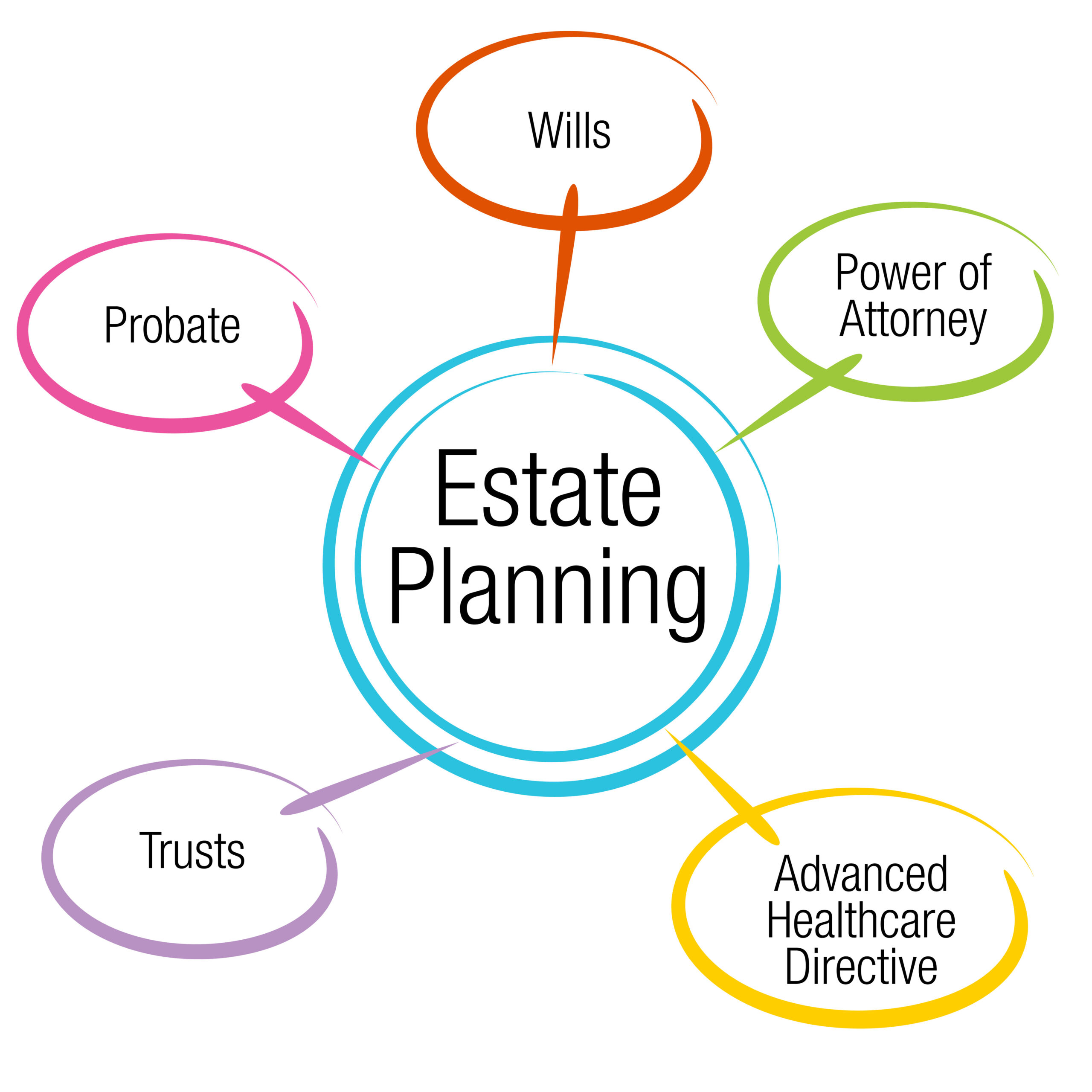

To start the estate planning process, consider whom you want to protect, what you want to protect, and the legacy you plan to leave. You should then collect and store all essential documents in a safe place. This includes legal documents and other important papers. The legal documents include the following:

Other vital papers include your birth certificate, marriage license, divorce papers, updated beneficiary designations, life insurance, long-term care insurance and property insurance. And your estate plan should also cover items other than the will or trust and include a plan if you become disabled.

Estate planning requirements vary by state, so make sure you have these documents safe and accessible to make it easier to transfer your estate when the time comes.

When you’ve gathered all these essential documents, contact an experienced estate planning attorney to create your estate plan.

Reference: My Home by Freddie Mac (March 16, 2023) “How Planning Your Estate Can Help You Prepare for the Future”

Yonkers Office (By Appointment Only)

Garden City Office (By Appointment Only)