The King of Rock and Roll, Elvis Presley, is an icon who conquered the music industry with his talent and charisma. He still has a loyal fan base who remember the "King of Rock and Roll" with the same passion and interest as they did in his lifetime. However, it's not just his music that draws people's attention; it's his estate planning that's also a topic of interest. Despite his sudden death in 1977, Elvis had done his estate planning, which left significant wealth for his heirs. But what are the estate planning lessons we can learn from Elvis Presley?

According to Kiplinger's recent article, "Five Estate Planning Lessons We Can Learn From Elvis' Mistakes," the Presley estate seems to have fallen short in crafting a successful estate plan. A well-designed estate plan ensures that valuable assets and legacy are passed down to the appropriate beneficiaries at the optimal time while preventing undeserving individuals from obtaining them.

A solid estate plan involving the right individuals, such as Elvis and Lisa Marie's children, can guarantee that desired beneficiaries receive their rightful inheritance. Timing is also essential, transferring assets when heirs are mature enough to benefit. By keeping unsuitable parties at bay, taxes and administrative charges are decreased, and heirs are protected from legal action, divorce, creditors, and further estate taxes upon their passing.

Priscilla Presley recently contested a 2016 amendment to Lisa Marie's trust, which sought to remove her as co-trustee alongside former business manager Barry Siegel. Although Priscilla's intentions may have been justified, the amendment lacked the necessary legal formalities. Fortunately, a confidential settlement has now been reached to resolve this matter.

After Elvis' passing, Priscilla worked diligently to expand his estate. Despite his immense popularity, his assets were mostly non-cash and worth only $5 million in 1977 (which equals roughly $20 million today, adjusted for inflation). However, the IRS disputed this valuation and demanded $10 million in estate taxes, claiming that the estate was actually worth much more.

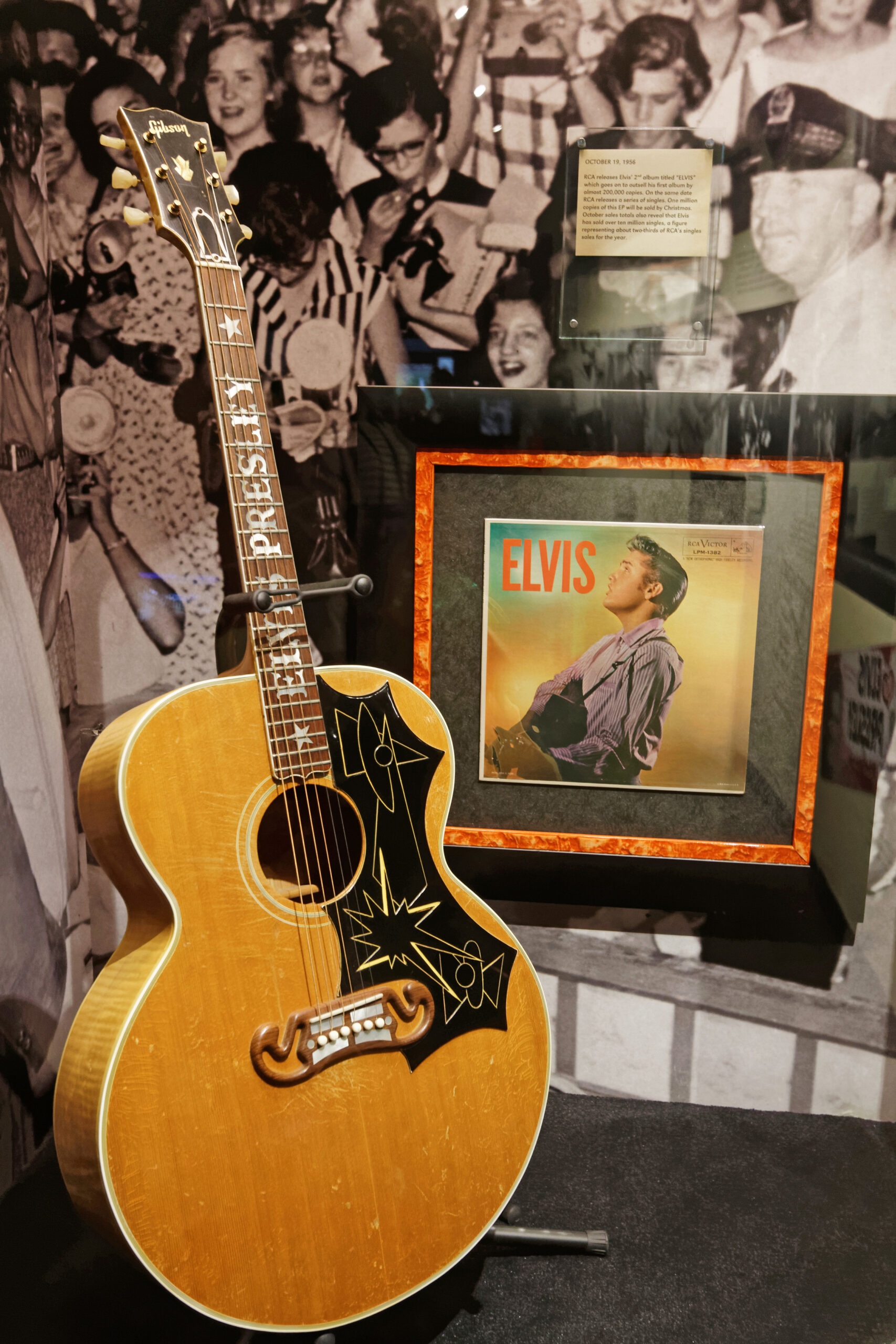

Although the estate of Elvis Presley didn't reap as much royalty income as anticipated, it was due to the decision of his business manager, Colonel Tom Parker, to sell the music catalog to RCA for $5.4 million. Unfortunately, only a meager $1.35 million was returned to the estate. However, Priscilla Presley took control of the estate and made wise decisions to turn things around. Through careful management of Graceland profits, merchandising, and royalties from post-RCA deal music, she grew the estate to a whopping $100 million.

The estate didn’t include as much royalty income as expected because Elvis’ business manager, Colonel Tom Parker, sold the music catalog to RCA for $5.4 million, of which only $1.35 million went to the estate. Priscilla then assumed control of the estate. From her wise use of Graceland profits, merchandising, and royalties for music recorded after the RCA deal, Priscilla grew the estate to $100 million.

In 1993, Lisa Marie turned 25 and was eligible to receive and control her inheritance. She established a revocable trust to hold her legacy, then appointed a businessman as her co-trustee with primary control over her assets. In two years, he sold 85% of her interests in Elvis Presley Enterprises, an entity The Elvis Presley Trust created to conduct business, including Graceland and worldwide licensing of Elvis Presley Products.

The deal was worth $100 million but brought the estate only $40 million after taxes, plus $25 million in stock in a future holding company of American Idol, later made worthless due to bankruptcy by its parent company.

With proper foresight, significant income tax could have been avoided during the sale, resulting in a more favorable financial outcome for the family. Unfortunately, Siegal's removal as trustee in 2015 amidst legal disputes with Lisa Marie was left unresolved and lingered until her unexpected demise in 2023. The case was ultimately settled.

The lessons from the King of Rock's estate:

Consider a trust, not a will. The trust avoids delays and higher costs and keeps private details private. Consider the use of a Blind Trust in certain situations for added privacy.

Make sure that your estate plan addresses estate tax issues. The goal is to reduce the value of the taxable estate and increase the value of your legacy to family and loved ones. The estate tax must be paid in cash within nine months of death. This often requires a sale of the estate or trust assets to pay the tax and can lead to heirs getting less than the total value of assets because of the need to come up with the cash. A testamentary charitable lead annuity trust (TCLAT) could have prevented the estate tax assessed after Elvis’ death and substantially benefited Lisa Marie.

Plan for a lifetime legacy. Lisa Marie gained complete control over her inheritance at age 25. First, however, she needed to prepare for the complexity of the business and other assets she inherited and learn how to maintain a lifetime of living within her means.

Plan for estate taxes on the sale of the family business. Careful planning can almost always reduce the tax triggered by the sale of appreciated property. Unfortunately, no tax mitigation planning was taken before the $100 million sale of Elvis Presley Enterprises. As a result, the maximum capital gains tax, federal and estate combined, can be more than 40%.

Carefully choose the successor trustee or executor and provide at least two alternatives. Elvis appointed his father, Vernon as the executor. Elvis died tragically in 1977 when Vernon was elderly and not well. Selecting a business manager as a trustee creates an inherent conflict of interest due to the business manager’s ability to profit from decisions made. A professional trustee would have been a better choice due to the complexity of the estate and Lisa Marie’s age.

Reference: Kiplinger (May 18, 2023) “Five Estate Planning Lessons We Can Learn From Elvis’ Mistakes”

Yonkers Office (By Appointment Only)

Garden City Office (By Appointment Only)